![]()

By Herbert Dreyer

Corporate Finance - KZN

Deloitte & Touche

What is securitisation?

“[Traditional] Securitisation scheme” means a scheme

- whereby a special purpose institution (“SPI”):

- issues commercial paper to investors,

- uses the proceeds of such issuance primarily to obtain various types

of assets, and

- makes payments in respect of the commercial paper so issued from the

cash flows arising or proceeds derived from the assets, consisting of

claims sounding in money, transferred to such SPI by an originator,

a remote originator or a repackager.

Where did it begin?

- 1934 National Housing Act passed in the US

| - Created Federal Housing Administration (FHA) which

insured loans made by private investors - 1938 FHA established Fannie Mae (Federal National Mortgage Association) to buy and sell federally insured mortgages - 1970 Freddie Mac (Federal Home Loan Mortgage Corporation) was established as a government chartered corporation |

- Word “securitisation” first appeared in the Wall Street

Journal in 1977, and in the same year the Bank of America concluded

the first securitisation transaction through Solomon Brothers.

- Thereafter Freddie Mac and soon thereafter Fannie Mae contributed

to creating a liquid secondary mortgage market in the US.

Why did it begin?

- The mismatch of funds due to regional imbalances, with people moving

to the West Coast (the sunbelt states):

| - Interstate banking regulation prevented banks and savings institutions from lending money outside their state boundaries. East Coast surplus funds could thus not be used in at the West Coast where funds were needed. |

-Interest rate regulation of mortgage- lenders (thrift institutions)

required a three per cent spread between the cost of funds and the rate

at which mortgage loans are advanced:

| - Interest rate mismatch occurred because mortgage loans were made at fixed rates, while lending institutions (thrifts) had to obtain funds at floating rates, causing an erosion of earnings in inflationary times. |

-Growth in demand for home finance as baby boomer generation reached

home-buying age in the 1970’s.

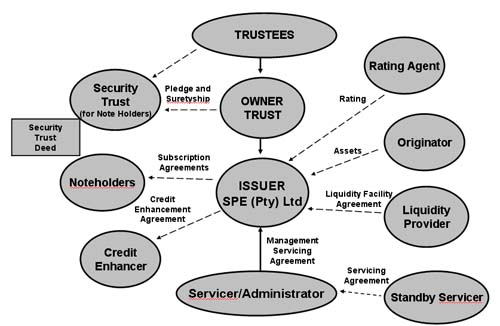

Basic Securitisation Structure

Use of SPVs

- To isolate identifiable assets/risks into a stand alone, self-sustained

entity which is no more than such assets/risks.

- Facilitates “true-sale” of assets

- Are not companies in substantive operations; they do not have any

business except acting as a legal instrumentality

Typical originators

- Application of securitisation techniques has greatly expanded recently.

- Typical users of securitisation are:

| - Mortgage financiers - Bank loans - Finance companies - Credit card companies - Hoteliers, rentiers - Public utilities - Intellectual property holders - Insurance companies - Aviation companies |

Typical assets securitised

- Financial assets

| - Long-term assets - Short-term assets - Revolving assets |

- Physical assets

| - Using transformation devices - Using secured loan structures |

- Whole business transactions

- Future flow transactions

Why securitisation?

- Lower cost – inherent cost and weighted average cost

- Alternative investor base – institutional and retail

- Matching of assets and liabilities

- Multiplies asset creation ability

- Frees up regulatory capital

- Improves capital structure

- Higher trading on equity with no increased risk

- Extends credit pool

- Reduces credit concentration

- Risk management by risk transfers

- Arbitraging opportunities – repackaging transactions

A typical securitisation process

| Step1: | |

| - The lender, also called the originator (typically a financial

institution), makes a loan to a borrower (the obligor). - The loan amount is transferred to the obligor and the obligor directs all repayments of the loan to the originator. |

| Step 2: | |

| - The loan is “warehoused” or kept by the originator,

until the originator has a sufficient volume of similar loans. |

| Step 3: | |

| - The originator sells the loans to a special purpose vehicle

(SPV) – a legal entity created by the originator. |

| Step 4: | |

| - The special purpose vehicle (SPV) pays for the loans by simultaneously

selling - certificates, representing ownership of the loans, to investors. - The funds obtained from investors are passed to the originator. - A credit rating agency rates the securities issued by the SPV. |

| Step 5: | |

| - A servicer is appointed, which provides administration for the

duration of the issue. - The duties of the servicer include servicing the loans in the SPV and servicing problem loans. - In many cases, the originator performs the role of servicer. - A trustee can also be appointed to ensure that investors are paid in accordance with the terms of the securities and to monitor the performance of the servicer. |

| Step 6: | |

| - In this final step, the borrower is instructed to make payments to the servicer and direct all inquiries to the servicer if the originator does not perform the role of servicer. |

Pass-through structure

- A straight forward participation of investors in the pool of receivables

– the SPV performs simple conduit function

- Collects and passes on payment, with no reconfiguration of the cash

flows

- Normally would require the SPV to collect incomes during a month,

and pass them on by the 25th of the following month

- Would result into creation of erratic cash flows

Pay through structure

- In this structure, the cash flows collected are reconfigured to meet

the investors’ requirements for differing maturities

- The SPV will reinvest the surpluses in specified securities/guaranteed

reinvestment contracts.

- In terms of legal and tax structure, investors are not given beneficial

interest certificates, but instruments which are paid off from -he collections.

- Created to resolve two basic problems of pass-through

| - Monthly repayment of principal - Long total maturity |

Future flow securitisation

- Means transfer of receivables that are yet to be generated, on obligations

yet to be created.

- Examples:

| - Airline tickets - Exports - Telephone revenue |

- Motivations

| - Piercing sovereign ceiling - Lower cost - Going beyond on-balance sheet assets |

- Provides investors with a mechanism of trapping receivables at the

source, thus eliminating exchange rate risk and sovereign risk

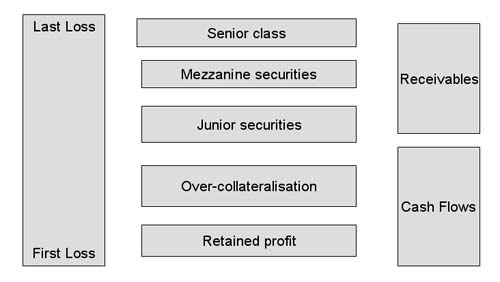

Credit enhancements

- The needed enhancement is a product of desired ratings

| - B rating requires enhancement of 1-1.25 times of

expected loss. - AAA rating requires multiple of 3-5 times expected loss - Expected loss is the cumulative loss over life |

- Factors affecting the extent of credit enhancements:

| - Quality of the collateral - Diversification of the portfolio - Historical performance - LTV ratio - Seasoning - Originator/third-party enhancement |

Typical structure of credit enhancements

Cost of credit enhancement

- All credit enhancement carry a cost

| - External credit enhancements: explicit cost - Structural enhancement: spreads on junior classes - Originator enhancement: higher cost of originator support |

- Credit enhancements and resulting ratings have mutually conflicting

impact on the weighted average cost of the transaction

- Objective is to reach an equilibrium where economic waste is avoided,

and transaction becomes protected.

Bibliography

- Kothari, V. 2008. Structuring & Modelling of Securitisation.

- Saayman, A. 2002. Securitisation as a liquidity source for small banks

in South Africa.

- Deloitte research. 2001-2008.